All Three Pillars Holding Up the Economy Have Cracked

Karl Marx and Henry Ford both understood the key pillar of an industrial economy: the workforce has to earn enough to buy the output of the economy. If the workforce doesn't earn enough to have surplus earnings to spend on the enormous output of an industrial economy, then the producers cannot sell their goods / services at a profit, except to the few at the top as luxury goods — and that's not an industrial economy, it's a feudal economy of very limited scope.

Marx recognized that capitalism is a self-liquidating system as capital has the power to squeeze wages even as the output of an industrial economy steadily increases due to automation, technology, etc.

Henry Ford understood that if his own workforce couldn't afford to buy the cars rolling off the assembly line, then his ambition to sell a car to every household was an unreachable chimera. (There were other factors, of course; the work was so brutal and mind-numbing that Ford had to pay more just to keep workers from quitting.)

If we say the three pillars holding up the economy, the conventional list is: 1) consumer spending (i.e. aggregate demand); 2) productivity and 3) corporate profits. These are not actually pillars, they are outcomes of the core pillar, wage earners making enough to buy the economy's output.

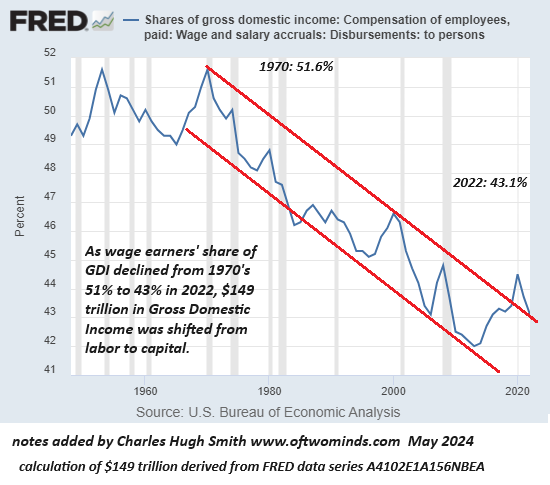

As the statistics often cited here show, the purchasing power of wages has been declining for almost 50 years, since the mid-1970s. This means the workforce's surplus earnings have bought less and less of the economy's output.

There are three ways to fill the widening gap that's opened between what the workforce has to spend as surplus earnings and the vast output of the economy:

1. Government distributed money. The government distributes "free money" to the workforce via subsidies, tax cuts and credits, or direct cash disbursements.

2. Cheap abundant credit. The cost of credit is lowered to near-zero and credit is made available to virtually the entire workforce so workers can borrow money to buy goods and services they cannot afford to buy from surplus earnings. If auto loans are 1.9%, the interest is a trivial sum annually.

3. Asset bubbles. Boost the value of assets via monetary policies to generate unearned "wealth" that can be spent (by either borrowing against the newfound wealth or by selling assets). This expansion of "free money" also generates the "wealth effect," the feel-good high of feeling richer, which increases the confidence and desire to spend more money.

There are intrinsic, unbreachable limits to each of these solutions.

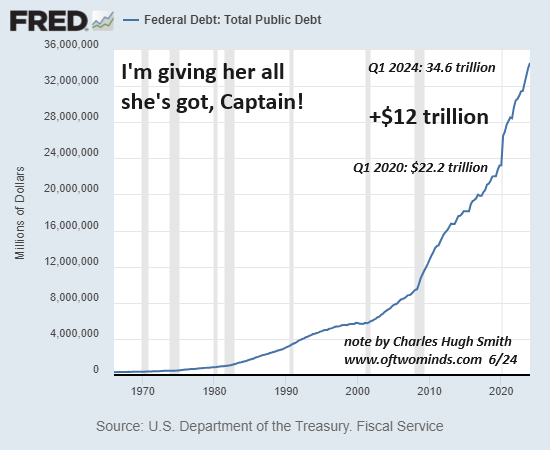

1. The government either "prints" or borrows the money it distributes to the workforce. Over time, low interest rates are unsustainable, despite claims to the contrary, and the interest paid on the state's vast borrowing consumes so much of the state's revenues that it starts limiting how much the government can spend. Once state spending stagnates or declines, this pillar breaks and the economy crumbles into recession / depression.

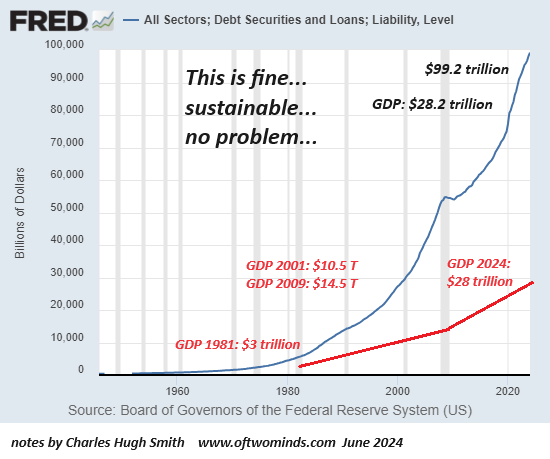

In other words, depending on the government to fill the gap between wages and the economy's output is a self-liquidating system.

2. The expansion of credit leads to defaults and bankruptcies. Relying on the ceaseless expansion of credit based on the declining purchasing power of wages is also a self-liquidating system, as the number of marginal borrowers steadily increases, as does the volume of marginal loans issued by lenders. Marginal borrowers default, triggering losses that push lenders into bankruptcy. This is a self-reinforcing cycle, as the economy rolls over into recession as credit contracts. More workers lose their jobs and default, more loans become uncollectible, and so on.

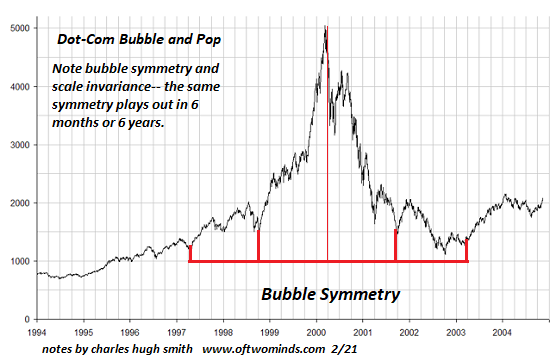

3. Asset bubbles concentrate the newfound wealth in the top 10%, exacerbating wealth-income inequality and pushing those left behind to gamble in an increasingly speculative financial sector as the only available means of getting ahead. Speculation is also a self-liquidating system as risky bets eventually go bad and the losses trigger a self-reinforcing feedback of selling assets to raise cash which then pushes valuations lower, triggering more selling, and so on.

All three of these pillars propping up the economy are self-liquidating systems, and they're all buckling. Federal borrowing is pushing up against the limits posed by the interest payments on soaring debt. Credit costs are rising and cannot return to near-zero due to inflationary forces. All asset bubbles eventually pop, and the higher they ascend, the more devastating the collapse.

Wages' share of the economy have been in structural decline since 1975:

Federal debt: and no, we can't "grow our way out of debt" by inflating asset bubbles and subsidizing consumer spending with federal debt:

Total debt, public and private: the acme of a self-liquidating system:

The pillars of consumer credit and federal borrowing are reaching intrinsic breaking points, and so everything is now depending on the asset bubbles in housing and stocks to keep inflating phantom wealth at rates high enough to support more borrowing and spending.

The problem is all asset bubbles pop, despite claims that "this is a new era." That was widely held in March 2000, too, just before the dot-com bubble burst and the Nasdaq fell 80%.

All three pillars propping up workforce spending are cracking. Plan accordingly.

New podcast: Seeking a Culture of Honor and Integrity with Emerson Fersch and Amy LeNoble (59 min)

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products in my Medium posts.

Written by Charles Hugh Smith

Visit me at oftwominds.com. As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products in my Medium stories.

What are your thoughts?

Oh my Gif. There is one and only one solution to the inequality and you fucking didn't even mention it. The government must take from the rich and give to the poor. Don't let the lucky winners keep all their winnings. It's as simple as this. Taxing the rich and giving to the poor has no negative economic effects as long as there is still some incentive left to work. Which is easy to guarantee by keeping the tax rate below 100%.

There are 1000 ways to do this and they all help. Tax the economy equally on which means mostly the rich are taxed and use the money to provide important services to all. Like free roads. Free side walks. Free firefighter services. Free security guards (police). Free education.

To do even more we can add minimum wage laws. Give the poor even large tax brakes with progressive taxes. Then add more with free food and housing for the poor or disabled.

But if you don't do enough of this redistribution to guarantee low levels of inequality them then the system will still create a rich class which will gain enough power to distort the system in their favor turning millionaires into billionaires.

The best way to stabilize the system and keep it working for all is to take the government out of the loop as much as possible. Don't tax the rich and let the government spend the money for the poor. Let the poor decide for them selves what services they consider important and let the economy optimize itself to provide it to them.

Tax the rich and give the money to everyone. A Basic Income system where everyone wins. Take the money from the rich and give to the poor to spend.

But the most fair way to do this is with a simple flat tax on all income. Tax all income, rich and poor, at a flat rate and then hand all that money back to the people as equal size checks.

In the US a 20% tax (on top of all current taxes) would fund UBI checks for all to the tun of around $1000 a month. Children and adults. Whether you work or not. Everyone gets free money to help support them. Which means in this example that 20% of all economic output would be shared by all citizens of the country.

A direct tax and redistribution caps the inequality. It's a pertinent simple fix to the natural inequality of capitalism. And it doesn't hurt the economy it stabilizes the economy by hursmtering there's always a mass market for consumer goods.

But no. S health stable economy that puts the wealth into the hands of the people is not what the voters vote for. They just voted to give all the wealth to greedy spoiled rich kids like Trump and his rich friends because they were told by the rich his to vote. They were told taxes and socialism is evil. And being stupid slaves they voted for more slavery. Yes let's give the slave masters better whips to hit us with. That will make us a better society!

221

UBI scheme like this will absolutely have negative economic effects. While I do agree with social security for the poor, creating a system of giving free money to people will never work.1. Once this gets implemented, there will absolutely be some fraction of the working population that will be disincentivized to continue working. Think middle aged people with savings close to retirement. If you have enough of these people quit on their jobs, good luck with the economy. Every company will have to go through a major upheaval to continue their business. This means stock market crash, major layoffs, and lower quality of life for most people.2. It's worth mentioning that for something like this to become a federal law would require a majority of politicians in Washington to vote for it. They do that and they are out of a job next election cycle. It's no secret that corporate interests control policy making.3. You mentioned that you want the poor to decide what services they get, yet you don't want government to be part of it. How do you propose the ~40 million poor will collectively decide? Facebook poll? Reddit post? You need some minimal amount of central authority (government) to facilitate this process.4. I'm worried for the direction this country is taking as you are. Inequality will continue to grow until it reaches a critical mass. Right now, the middle class is still sizable or put another way, enough people believe they can become rich one day. When this changes, then our economic system will start the long process of reform.

8

1. It's been a common objection to UBI for 50 years that "people won't work". But yet, every test done shows that's not true. UBI has been tested over and over and over. What people "think" will happen (collapse of the economy) doesn't prove to be true.First off, if the size of the UBI was 100% of the economy then sure, we are talking pure communism where everyone is paid for free and no one is paid for working but yet "expected" to work for the good of the collective. A lot of people would work for the good of the collective but the optimization power of capitalism fails to work when both people and business have no incentive the produce efficiently. No incentive to work smarter or create new goods.But no UBI is 100% of the economy. And most important, any real full scale UBI should start out small, exactly because of the risks, then grow.The state of Alaska has had a UBI where everyone in the state gets free money since the 1976s. Were you aware of that? Have. you heard of Alaska having an economic collapse? It hasn't. 48 years of free money for everyone and all is still fine.Because for one, the "free money" is very small. It amounts to around $1000 a year, paid only once a year.So for those that fear a UBI killing the economy, we can start small. Say $100 a month checks for everyone. That's about the same as the Alaska UBI and unlikely to cause any economic harm. But it can be tested at that size and see how the economy and people respond to it.If there is no sign it's causing harm to the economy, then it should be slowly raised in small steps over time in order to give people a better safety net.There's good evidence to suggest that a UBI which is is larger as 50% of an economy will work just fine with no economic down turn. But you sure as heck would not try that without first starting small and growing towards it.And sure, some people will chose not to work. But the thing is, a larger portion of the people aren't contributing much to the economy to start with, so they don't really need to be working. The only reason they are working, is because our current system forces everyone to work if they want to eat.And keep in mind that MOST people aren't working most of the time anyway. Kids in school don't work. Most people don't work more than 5 days a week. People retire and stop working when they get older. But yet, And then lots of people simply choose not to work, and do other things for years.If we work for 8 hours a day and sleep for 8 then there's 8 hours we aren't working as it is. And that doesn't count weekends or vacations or sick leave etc. The total number of hours most people work in the lives are far less than 1/3 of their life as it is. But yet the economy remains productive and growing at the exact same rate for 200 years (about 2% per person per year). The fact that some percentage of the people will spend a little less than 1/3 of the lives working, isn't going to have an effect.The low paid workers really aren't needed in the economy. A lot of the low end of minimum wage workers don't need to have jobs. If you don't have skills needed by the economy, then intead of getting a crap miimum wage job so yiuo can eat, go back to school and improve your skills so you can get a good job. But the poverty trap prevents people from escaping provery. An UBI can allow people an easy path to a high paid job.Only 60% of economic output comes from workers. 40% of economic output we pay for comes from natural resources. Land value, mineral values, patents, trade secrets, etc. The lack of workers doesn't destroy the value that wasn't about workers to start with.If 1/2 of all the workers stopped, at best you are talking about the economy taking a 20% dip. But in reality nothing like that would happen. The guys making $100k a year and up won't be motivated to stop working just because they get a free $12K a month more. The ones that are likely to quit are the ones making near minimum wage. Why work a a crap minimum wage job when the best it will do for you is double your income over your UBI?But if all the minimum wage workers quit, what would the economy do? It would find ways to provide goods and services without them. Retail stores like McDonalds doesn't need as many workers as they have. A good bit of the operation of restaurant can be automated. It already is automated with aps to place your order. The customer can be asked to do more as well. Just as when they made us the be our elevator operator and push the buttons for ourselves, and phone operators and dial our own phones, and pump our own gas, and scan our items at check out. The customers can be asked to clean up after themselves at a McDonalds simply because they don't have the staff to do if for you. If you don't have cheap labor, businesses restructure to provide the best services they can with only limited expensive labor. They automate more for exmaple.And then something else critical happens becuae of UBI. When the people all quit because the wages suck, and business MUST HAVE people doing jobs (they aren't jobs that an be automated or replaced yet), what happens? The business are forced to pay higher wages to motivate more people to work in the crap jobs. The business are forced to make the work experience betteer.f. Get rid of the the crap bosses because a nasty abusive boss can't get people to work for them when all the people have UBI (and their entire family has UBI), so people just strike. They walk out and say so long to bad jobs.You don't need minimum wage laws with UBU because if the UBI replaces the minimum wage. Let workers and business negotiation for any wage they are willing to do. If I really want the opportunity to work at some job, then maybe I'll even pay THEM to hire me! Because the job is something I really want to do, or be a part of, and not something I NEED to do for money.But when there are important jobs that people need to have done, but et most people don't want to do it, maybe trash collection as an example, then in order to get enough people to ride a trash truck picking up truck at 5AM in freezing old rain, you will have to actually pay them a lot of money, which is good for the workers.I UBI does far more than "give people free money" it shifts the balance of power from the businesses to the workers. It can do the same thing Unions do, without any need to have unions anymore. Just having a UBI in a country gives people the power to walk away from bad jobs. When business can't find workers to abuse, they are force to pay them decent wages (or find ways to produce the goods and services with less workers) or go bankrupt.Same thing for a lot of stuff we do with worker safety and discrimination laws. Almost ALL of those can go away and be replaced with a simple UBI system.The economy by default doesn't value people. It values consumers with money. But since it doesn't care who has the money, it works just fine when only the rich have money and the economy is only woking for the rich. A UBI shifts money to everyone, and that forces the economy to serve EVERYONE. Everyone's needs become important, including the need not be enslaved by the economy.Much of our current welfare systems can all be replaced with a dead simple, low overhead cost UB I system where everyone is taxed, and everyone gets the same UBI checks.The UBI should be as large as possible without causing the economy to slow to below it's current 2% growth rate. But the size of the UBI can't be calculated to find that point. It must start small and grow slowly over a time to find out how large it can be before it creates actual economic problems.With a small UBI, like $100 a month for everyone at the start, there will be no market collapse, or massive layoffs. Nor will people suddenly all decide to stay home. So see what actually happened, and then keep trying to increase it (while also slowly removing or reducing other welfare systems that aren't needed because of the UBI).2. Corporate interests won't override voter interest. Alska voters voted for a UBI and got it. Corporte interest tried to end it. The voters forced it to be become part of the state Constituion to block them. We still hae a democracy. If the voters really want something, they get it.The voters haven't shown an interest in a UBI. Few actually understand it. Many thing it will can't work (as you said) but there's no indication that's true. Most that reject it do some on ideological grounds (communism is eveil) vs any sort of rational grounds.Andrew Yang ran for President in 2020 on a UBI platform. He didn't last long, Not even in the Democratic primaries yet alone how he would have done in the general.All the things people site a problems with society, would be gone with a UBI. But few understand this. So they don't vote for it.The rise of AI is fast approaching and it's going to lead to a swift colapse in empl;ouy,ent with no colapse in economic activity. The economy will be by the rich, for the rich when the rich can just build robots to do all the work instead of hiring people. I do hope people catch on to the fact that a UBI is what they will need to vote for when that time comes in the next few decades. But even that is unclear.3. "You mentioned that you want the poor to decide what services they get, yet you don't want government to be part of it. How do you propose the ~40 million poor will collectively decide?"I thought that was obvious. Sorry. They decided what they want by spending their UBI money. They each buy whatever it is that is important to them. Food, shetler, education.This is how capitalism works. The consumers spend money to tell the economy what they like, and the economy bends over BACKWARD to give them more of what they like -- it even works to figure out what the consumers will want, before the consumers even know that's what they will want.It's far better to give a poor person $1000 a monthy instead of supplying them with $1000 a month "free" housing in housing development for the poor that forces them to live where the govern,ent tells them to live. What if hey have a skill where they can get a low paying job somewhere else in the city but the only housing income they cam get is being force to move into the building the gobern,ent build on the other side of town? In no case is is good for the government to decide where people should live, hat type of home they should have, when instead, the people could just have the money and spend it in the way that makes the most sense for them."4. I'm worried for the direction this country is taking as you are. Inequality will continue to grow until it reaches a critical mass. Right now, the middle class is still sizable or put another way, enough people believe they can become rich one day. When this changes, then our economic system will start the long process of reform."A UBI would fix ALL OF THAT overnight.A UBI is like a tax on inqualty. It's paid for mostly by the rich, and does the most good for the poor. It's a direct transfer from those that found a way to make a lot of money, to those that didn't find such a path in their lives.The prob lem of inqualty comes from the fact that caplitm rewards the rich, and makes it easier for the rich to get richer. It's an inherently unstable system that serves the rich, but not the people.A UBI flips the equaltion upside down buy taking the power away from the rich, and giving it to the people. Just as have the right to vote in a democracy takes the power away from the dictators and gives it to the people. Equal voting rights for all.A UBI is a guaranteed economic power for all. It can't be 100% of the economy, but it can be enough to guarantee that there's a lower limit of everyone's economic power. From birth to death, people are given guaranteed economic power and freedom for life. If you want a richer life, you have to work for it, but you get that that highly secure safety net that makes getting ahead far easier, and allows people more risk taking in their economic lives. It gives economic opportunity to all, without complex government programs to try and decide how deserves what opportunities.But instead of voting for a UBI, the people in the US voted for a fascist dictator to take all their money away from them. I can't fix stupid. If that makes them feel good for a little bit, I'll let them have that.But when the AI job market crash comes, I do hope they understand they will need to demand a UBI to save themselves.

5

A flat tax is inherently regressive. A highly progressive tax rate, as the US had from the 30s until Reagan scrapped it in the 80s, brought exactly the broad middle class that brings stability and continued growth to the nation as a whole.Tax enough to keep the number of obscenely wealthy extremely small, and still not orders of magnitude wealthier than the middle class. As it used to be.Tax capital like income (also as it used to be).Do not allow stock buy backs (also as it used to be).There are lots of other things to be done, but those alone would improve the US economy massively.We know this is true because we've already done it.

4

No comments:

Post a Comment