Why utilities don't think Trump will stop the clean energy transition

Utility Dive's 2017 State of the Electric Utility Survey shows a sector reshaping itself for a cleaner, more distributed future — no matter what happens with the Clean Power Plan

Today, President Trump is poised to release a long-anticipated executive order to roll back the Clean Power Plan, the Obama administration's signature climate initiative.

The order is expected to be accompanied by directives to lift a moratorium on federal land coal leases and to cease the use of the social cost of carbon — all part of a broad campaign to dismantle environmental regulations on the power sector that Trump blames for the decline of the coal economy in the United States.

But while rescinding the rules could help slow coal power's decline in the short term, analysts say it is unlikely to reverse its long-term downturn, mostly due to the economics of natural gas and renewables.

That attitude is shared not just by market observers, but by electric utilities themselves. According to Utility Dive's fourth annual State of the Electric Utility Survey, the sector plans to keep moving steadily toward a cleaner, more distributed energy future — no matter what happens with the Clean Power Plan.

Early in 2017, Utility Dive surveyed more than 600 electric utility professionals across the United States. The results indicate that utilities expect to source more power from renewables, distributed resources and natural gas in the coming years, while coal continues to decline.

The results reflect a sector that largely supports some form of carbon regulation on the federal level. Though more than two-thirds of respondents indicated their company owns generation resources, only a quarter said they do not want the federal government to pursue a policy of decarbonization whatsoever.

Those responses are two of the top-line takeaways from this year's 92-page report, which reveals a sector that is grappling for policy certainty on both the state and federal levels as it deals with an influx of new technologies and customer demands. Here are some more key findings from the report.

Most pressing challenges

President Trump's push against carbon rules may grab headlines, but the 2017 survey indicates utility executives are significantly more concerned about other issues.

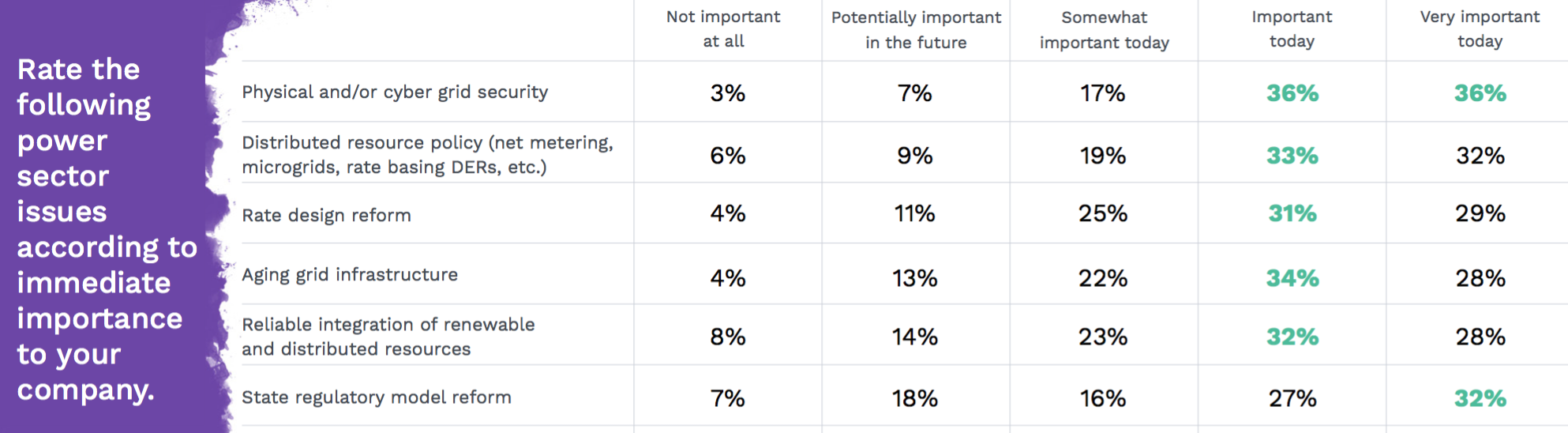

For the first time, physical and cyber security topped the list of utility sector concerns in 2017, with nearly three quarters of respondents indicating it is either "important" or "very important" today.

Security concerns were followed by more familiar utility issues with distributed energy policy, rate design reform, aging grid infrastructure and reliable integration of renewables and DERs — all issues which tracked close to the top in past Utility Dive surveys, the report notes.

The responses reflect a "deep unease in the utility industry over the state of its cyber protections," according to the survey, after media reports of Russian election hacking and a scare over possible Kremlin malware at a Vermont utility.

Get electric utility news like this in your inbox daily. Subscribe to Utility Dive:

But security worries, while paramount to utilities, are far from their sole concerns. A majority of respondents indicated that the top nine issues facing utilities are either "important" or "very important" today, suggesting that the "growing complexity of the power sector and a rapid influx of emerging technologies are combining to create new concerns for electric utilities, while long-standing issues remain unresolved."

Power generation

While utilities largely expect to add more renewables and gas in the coming years, the 2017 survey does include one bright spot for coal.

A plurality of respondents indicated their outlook on the resource is generally more favorable as a result of the Trump presidency, though they also overwhelmingly indicated they do not expect to source more power from coal plants themselves.

Even if new coal plants are not planned, a rollback of the Clean Power Plan could allow some existing plants to operate longer in the future.

The future impacts of any regulatory actions still remain unclear. Earlier this year, the EIA forecasted that rescinding the Obama-era rules could allow coal to recapture the top spot in the U.S. power mix. But, the federal agency warned, an expansion of natural gas production could easily counteract that and contribute to an even faster decline for coal.

The sector's uncertainty over the impacts of future environmental and market policy looms large in the 2017 survey. For the first time, respondents named policy uncertainty as the top challenge associated with their changing fuel mixes, beating out both customer cost and reliability concerns.

DERs and rate design

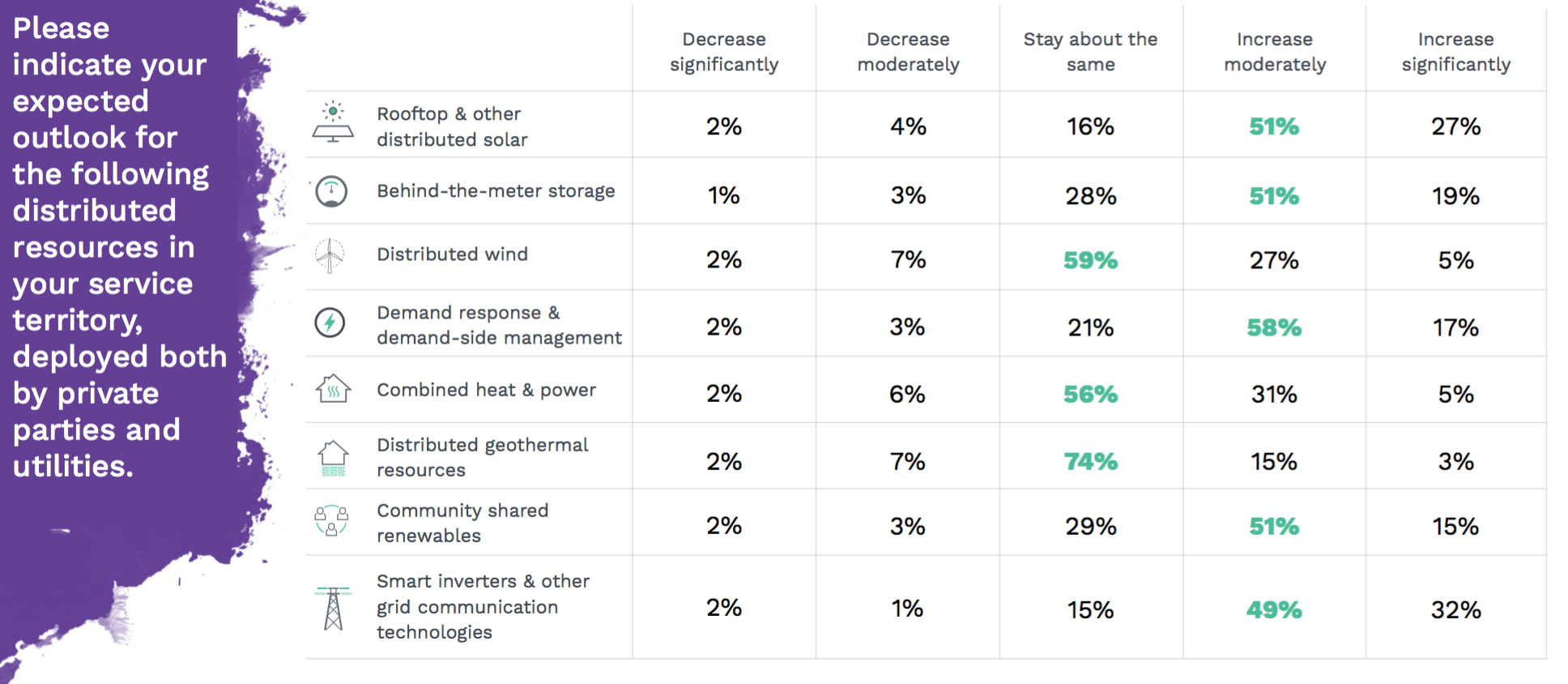

While utilities appear less sure about the future of bulk power resources, they are more confident about the trajectory of distributed energy resources.

More than 70% of respondents indicated they expect moderate-to-significant growth in rooftop solar, demand-side management and behind-the-meter storage. To facilitate the interconnection and control of those resources, more than 80% said they expect to see growth in grid communication technologies

As distributed resources grow, utilities expect to push for rate design reforms to mitigate their impacts and recover fixed grid costs. As in 2016, the sector indicated broad support for time-of-use rates and fixed charge increases, while demand charges were less popular.

But more than controlling the spread of DERs, the survey shows electric utilities are eager to get in on the game themselves. 90% of respondents believe their company should have a DER business model, with over half indicating they should pursue rate-based investments in distributed resources.

Sentiment for rate-basing DER investments was strong across the industry. About 95% of respondents indicated utilities should be able to rate-base DERs under some circumstances, and more than 70% said they should be considered appropriate in most cases. This comes in stark contrast with the opinions of prominent solar advocates, who believe that utilities should typically not be allowed to rate-base DERs given their monopoly advantages.

Utility regulation

Utilities may prize certainty in most things, but if there's one aspect of the industry they overwhelmingly want to change, it's their regulatory models.

For the third year running, utilities named their regulatory model as the largest impediment to the evolution of their business models — edging out cost concerns.

Though cost-of-service regulation has largely governed utility investments for the last century, respondents indicated they expect to move away from the traditional model in coming years and integrate more performance-based ratemaking.

That move would largely be welcomed by the sector. Fewer than 10% of respondents indicated they think pure cost-of-service regulation is appropriate in the 21st century, while a plurality favored a mixture of traditional models with performance-based incentives.

Market reforms, plant retirements and more

The full State of the Electric Utility 2017 report contains a treasure trove of other findings on electricity market reforms, power plant retirements, utility regulation, DER policy and more. To date, it is our most comprehensive look at the attitudes of sector professionals and includes analysis by region and utility business model types.

We will further explore a number of trends from the report in the coming weeks. In the meantime, the broad narrative for the sector is clear: Even in the absence of federal action, favorable economics, customer sentiment and proactive state policies will combine with existing utility plans to continue to push the transition toward clean energy forward.

"In 2017 and beyond," the survey concludes, "the continued evolution of the power sector — and the goal of decarbonization — may well rest with these states and their utilities."

No comments:

Post a Comment