|

Friends,

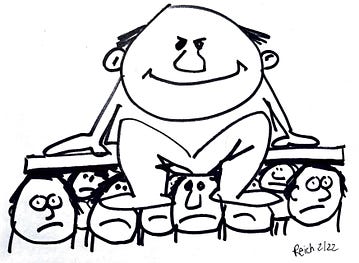

From time to time, I use this letter to debunk an economic myth that's used to justify the staggering inequalities of income and wealth that characterize modern America.

Today, I'm taking on the idea that people are paid what they're "worth."

According to this mythology, workers at the bottom don't deserve more than the minimum wage (the federal minimum is still $7.25 an hour — where it's been stuck since since 2009). If they were worth more, they'd earn more.

By this logic, the typical McDonald's worker is "worth" about $9 an hour (depending on the state and locale) while the McDonald's CEO is "worth" the $20 million pay package he received last year.

The notion that people are paid what they're "worth" is by now so deeply ingrained in the public consciousness that many who earn very little assume it's their own fault they don't earn more. That they simply lack the skills they need to be paid more.

The mythology also suggests nothing can be done to change what people are paid. It's simply the way the free market works.

Meanwhile, according to this same view, CEOs who rake in tens of millions and Wall Street traders who rake in hundreds of millions are simply being paid what they're "worth" because that's what the market has dictated.

Rubbish.

The "paid what you're worth" myth ignores power and disregards policies that have made inequality skyrocket.

Consider, for example, the demise of antitrust enforcement, which has given big corporations the power to set prices, make record profits, and reward their CEOs with unprecedented compensation.

Or the attacks on labor unions, which have reduced union membership from over a third of all private-sector workers in the 1950s to just 6 percent today, with the result that most workers have little or no bargaining power to get raises.

Or the reliance on the Fed's monetary policy to fight inflation by raising interest rates and slowing the economy, thereby suppressing workers' wages rather than corporate profits.

Or the ways the super-wealthy have gamed the tax system so that they now end up paying a lower tax rate than most middle-class Americans — and can pass on their wealth to heirs tax free (via the "stepped-up basis at death" rule).

All of this has resulted in a massive shift in wealth — from workers to owners.

Yet those at the top don't want to talk about power or policy. Instead, they justify their staggering incomes in three ways:

Trickle-down economics.

They claim that their wealth trickles down to everyone else as they invest it and create jobs. But as we know, wealth at the top has soared for decades and nothing has trickled down.

The free market.

They talk about "free market" forces beyond their control. But remember, markets are created by rules. These rules don't exist in nature; they are human creations.

The political power of the wealthy has let them change the rules for their own benefit — busting unions, monopolizing industries, and reaping big tax cuts.

Their own superior talents.

Sure, they may be talented, but this doesn't justify the staggering sums they are now taking home relative to what they took home years ago.

The typical CEO of a big company is now raking in 399 times more than their typical employee. In 1965, the typical big company CEO took home 20 times more than their typical employee.

Nor does their talent justify the amount of wealth they will pass to heirs, much of it tax free. The biggest intergenerational transfer of wealth in history will occur over the next 25 years as the richest 1.5% of Americans hand down roughly some $36 trillion dollars to their children and grandchildren.

This doesn't make those heirs superior. It makes them lucky.

The reality is there's no justification for today's extraordinary concentration of wealth at the very top. Or for how little people at the bottom are paid.

The "paid what you're worth" myth has proven a cruelly effective way to put the blame on workers for not getting ahead while suggesting nothing can or should be done to raise their wages — giving the rich and powerful cover to rig the game for their own benefit.

It is distorting our politics, rigging our markets, and granting unprecedented power to a handful of people while millions of Americans struggle to get by.

Don't fall for it.

No comments:

Post a Comment