Evidence that a Universal Basic Income is, if anything, "too affordable".

Could Australia afford a Universal Basic Income such that everyone would receive 25, 000 dollars, with which they could do whatever they wanted? Would it cost more than we currently spend? [Short answer: in many cases, it will actually cost less.]

So far, when talking about a UBI at "pubs" (let's be honest, I can only afford to drink in backyards), I run up against the criticism that it "just isn't affordable". I found it frustrating to find the calculations on this, so eventually learned to perform a back-of-the-envelope technique by plagiarising the work of a far more intelligent person who had already done this for the United States.

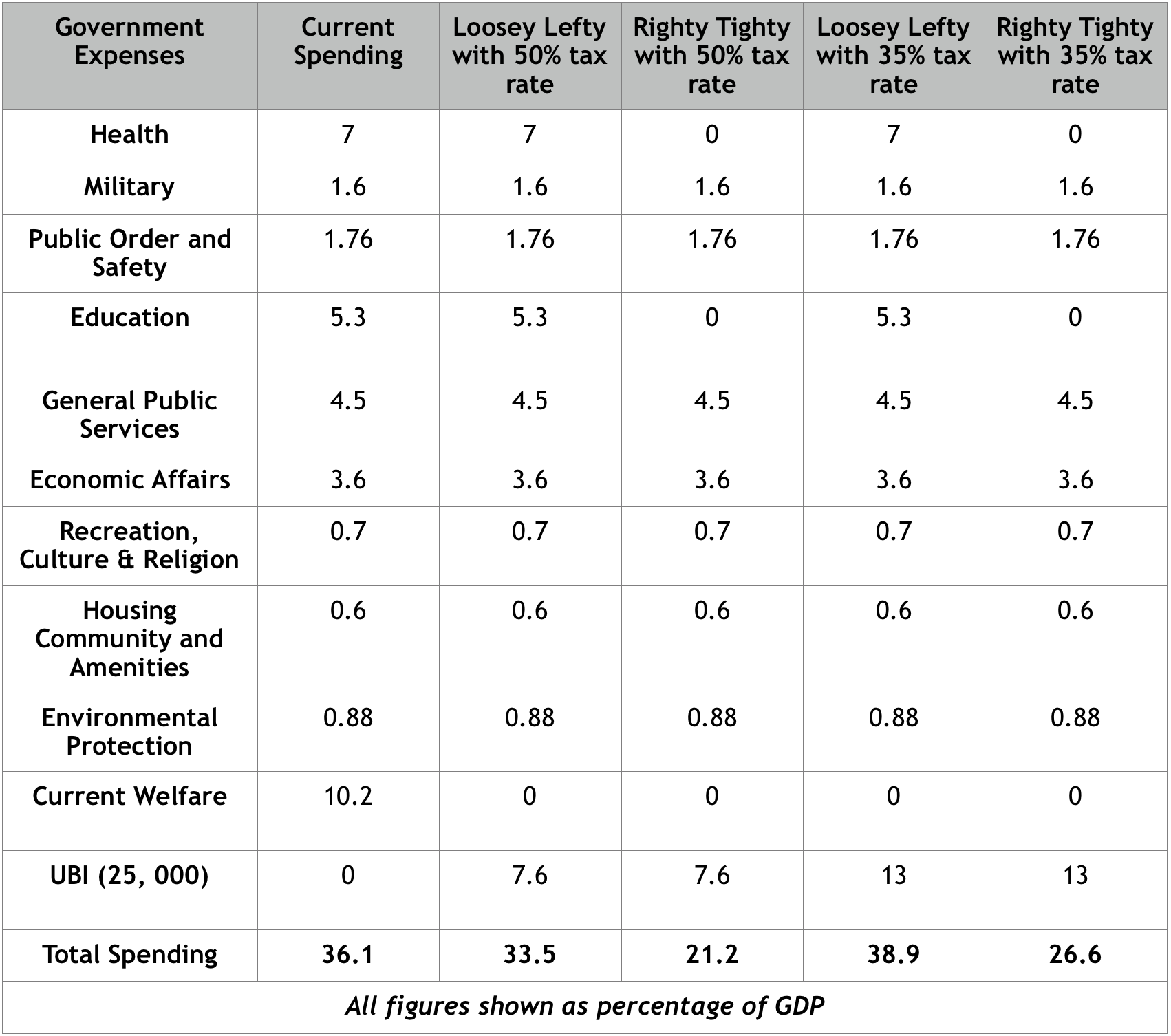

The only change I made was to calculate the spending as a percentage of GDP. The benefit of this was that I could rely on OECD data that simplified the problem of dealing with both state and federal spending. As such, I was able to provide estimates for both a Loosey Lefty version (which maintained current health and education spending), and a Righty Tighty version (which cut current health and education spending, leaving these services to be delivered by private health and education providers, and paid for via the new UBI).

A Universal Basic Income, under this arrangement, can be understood as a 25, 000 dollar tax deduction. Whatever the income tax a person pays, whether it is 1 dollar or 50, 000 dollars, it is subsidised by the 25, 000 dollar UBI. An unemployed person doesn't pay income tax, so when their zero tax is subsidised by the UBI, they end up receiving the whole 25, 000 dollars. If someone earns one dollar then, because there is no tax free threshold, they would still pay tax. At 35%, they would pay 35 cents. However, because everyone receives the UBI, their 35 cents of tax is subisidised by the 25, 000 dollars. As such, they end up receiving $24, 999.65 of "net UBI". Because everyone earns a different amount of money, and pays a different amount of tax, they receive a different "net UBI".

This basic mechanics of the UBI is important in calculating its cost. If the 25, 000 dollars is simply multiplied by the number of Australians, a shockingly large figure appears. 600 billion is very scary. However, the actual cost of the UBI, the amount of money that "net payers" pay to "net receivers" is a completely different figure. It can only be calculated using data that shows peoples income. Thus, to calculate the cost of the UBI, I relied on Census data that lists the number of people who exist within certain income brackets. I could not (and did not want to) calculate for every person individually, because the data gives income in ranges (1–100 dollars, 100–150 dollars, for example). As such, I first had to select the middle income figure of each income range. Then, I multiplied each of these income figures by two different tax rates (35% and 50%). Having calculated the tax for each income range, I subtracted the 25, 000 dollar UBI. This gave me the net UBI for each income range. When I multiplied this by the number of people in each income range, I had the total figures for all net recipients. I could then divide this figure by Australian GDP, in order to compare the cost of the UBI to current government spending.

Doing this exercise helped me to better understand how funding a UBI works. The cost of the UBI is determined not only by the amount of UBI, but also by the tax rate. This is because a lower tax rate will result in a larger number of net recipients. In any case, by crunching the numbers on a UBI of 25, 000 dollars at two different tax rates, I found that, under a Loosey Lefty model, the cost remained slightly more than current government spending, or significantly less. Under a Righty Tighty model, spending was completely slashed, to the point that it would be potentially more reckless and radical to implement the fiscally "conservative" option.

Conclusion: this very simple calculation is useful only for providing a rough gauge of how costly a Universal Basic Income would be. The 25, 000 dollar figure that I used is far higher than most UBI proposals. This means that these figures show quite high costings for Universal Basic Incomes, and that much lower basic incomes would be even more affordable. While these results should be treated with a grain of salt, they indicate that initial experimentation with a UBI is itself affordable. It is not, of course, a comment on what the flow on effects to the economy would be, or on which tax system would actually be appropriate. All it suggests is that sufficient wriggle room exists for experiments in many different UBIs.

WRITTEN BY

Toldandretold

|

No comments:

Post a Comment